Financial Advisor Magazine Fundamentals Explained

Wiki Article

See This Report on Advisor Financial Services

Table of ContentsA Biased View of Financial Advisor MagazineAn Unbiased View of Financial Advisor Near MeFinancial Advisor Jobs Can Be Fun For EveryoneThe Ultimate Guide To Financial Advisor Ratings

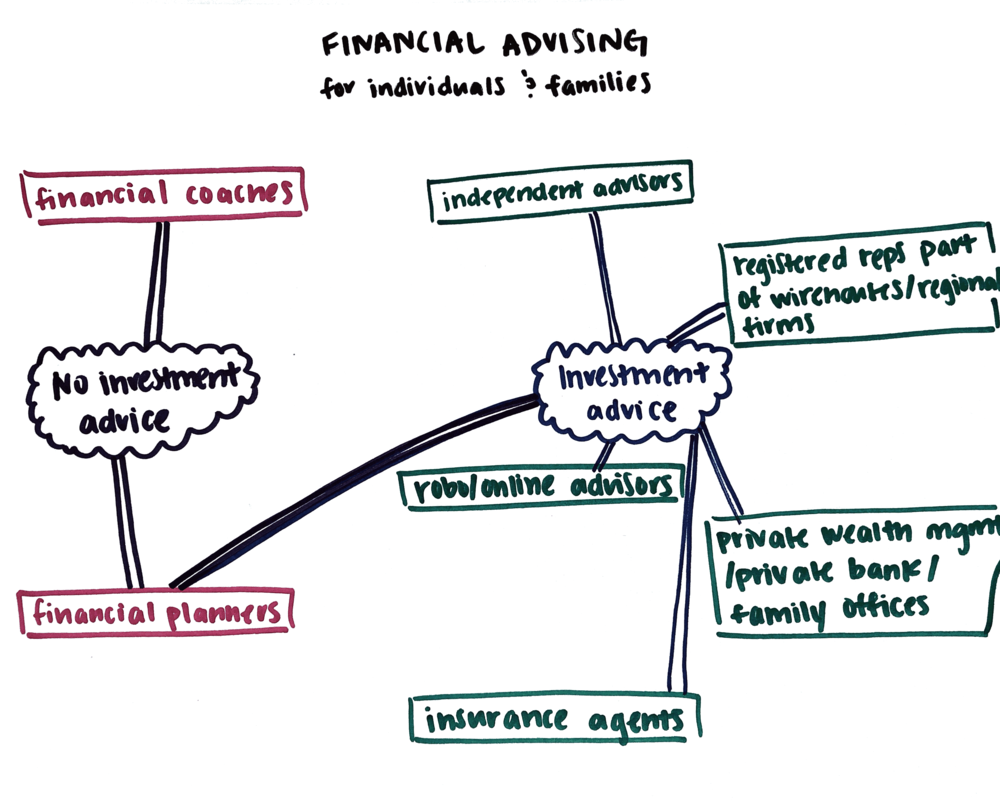

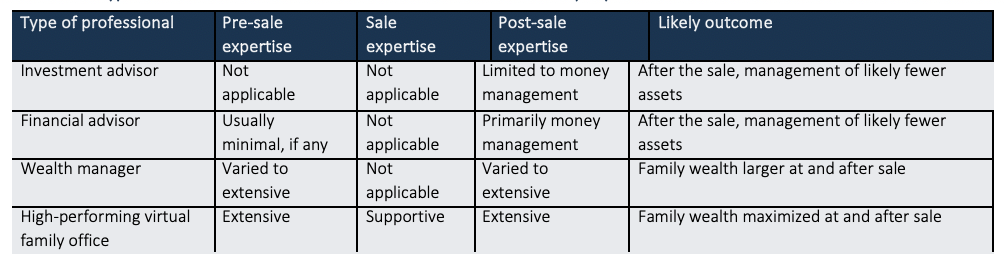

There are a number of types of monetary experts around, each with differing qualifications, specializeds, as well as levels of liability. And also when you're on the search for an expert fit to your needs, it's not uncommon to ask, "Just how do I know which monetary expert is best for me?" The solution begins with an honest accounting of your needs and a little of research.Kinds of Financial Advisors to Take Into Consideration Depending on your economic demands, you might decide for a generalized or specialized financial expert. As you begin to dive right into the globe of seeking out a financial consultant that fits your needs, you will likely be offered with numerous titles leaving you asking yourself if you are contacting the right person.

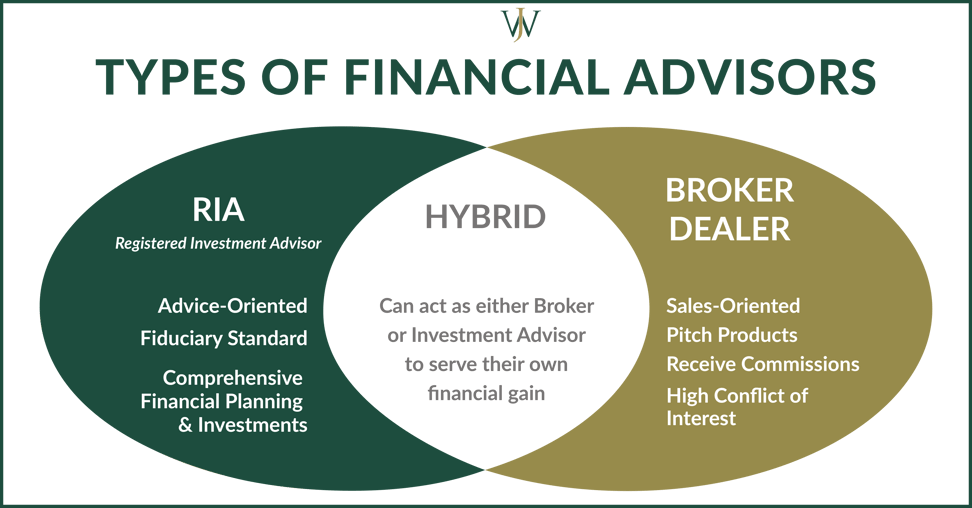

It is essential to keep in mind that some monetary experts likewise have broker licenses (definition they can offer protections), yet they are not solely brokers. On the very same note, brokers are not all certified just as and are not financial experts. This is just one of the numerous factors it is best to start with a certified economic organizer that can advise you on your investments as well as retirement.

What Does Financial Advisor Definition Do?

Unlike financial investment advisors, brokers are not paid directly by customers, rather, they earn payments for trading supplies and also bonds, and for offering common funds as well as other items.

An accredited estate organizer (AEP) is an advisor who specializes in estate planning. When you're looking for a monetary advisor, it's nice to have a suggestion what you want help with.

Much like "monetary expert," "monetary coordinator" is likewise a broad term. No matter of your certain requirements as well as economic situation, one standards you ought to highly think about is whether a possible expert is a fiduciary.

The Buzz on Financial Advisor Jobs

To protect on your over at this website own from a person that is just attempting to obtain even more cash from you, it's an excellent concept to look for an expert who is signed up as a fiduciary. A monetary advisor who is signed up as a fiduciary is required, by regulation, to act in the finest rate of interests of a customer.Fiduciaries can just recommend you to use such products if they assume it's really the very best economic choice for you to do so. The United State Stocks and also Exchange Payment (SEC) controls fiduciaries. Fiduciaries that stop working to act in a customer's benefits could be struck with penalties and/or imprisonment of up to ten go to this site years.

Nonetheless, that isn't because anyone can get them. Obtaining either accreditation needs a person to go through a selection of courses as well as examinations, in addition to making a set amount of hands-on experience. The result of the qualification process is that CFPs as well as Ch, FCs are fluent in subjects throughout the area of individual finance.

The charge might be 1. 5% for AUM between $0 as well as $1 million, however 1% for all properties over $1 million. Fees normally decrease as AUM increases. An advisor that generates income entirely from this monitoring charge is a fee-only expert. The option is a fee-based consultant. They appear similar, but there's a crucial distinction.

About Financial Advisor

An advisor's administration charge might or may not cover the costs linked with trading protections. Some experts also bill an established fee per transaction.

This is a solution where the advisor will certainly bundle all account monitoring expenses, consisting of trading costs and expenditure ratios, right into one comprehensive charge. Because this charge covers more, it is generally greater than a charge that only includes administration as well as excludes things like trading expenses. Wrap fees are appealing for their simplicity however additionally aren't worth the expense for everyone.

While a typical consultant usually bills a charge between 1% and 2% of AUM, the fee for a robo-advisor is typically browse around these guys 0. The big trade-off with a robo-advisor is that you typically do not have the capacity to speak with a human advisor.

Report this wiki page